26Jul

Investment Survival!! By Jon Bennion-Pedley

If you are to survive and thrive in the greatest economic crisis of our lifetimes then you need to focus on, and invest in, the right things:

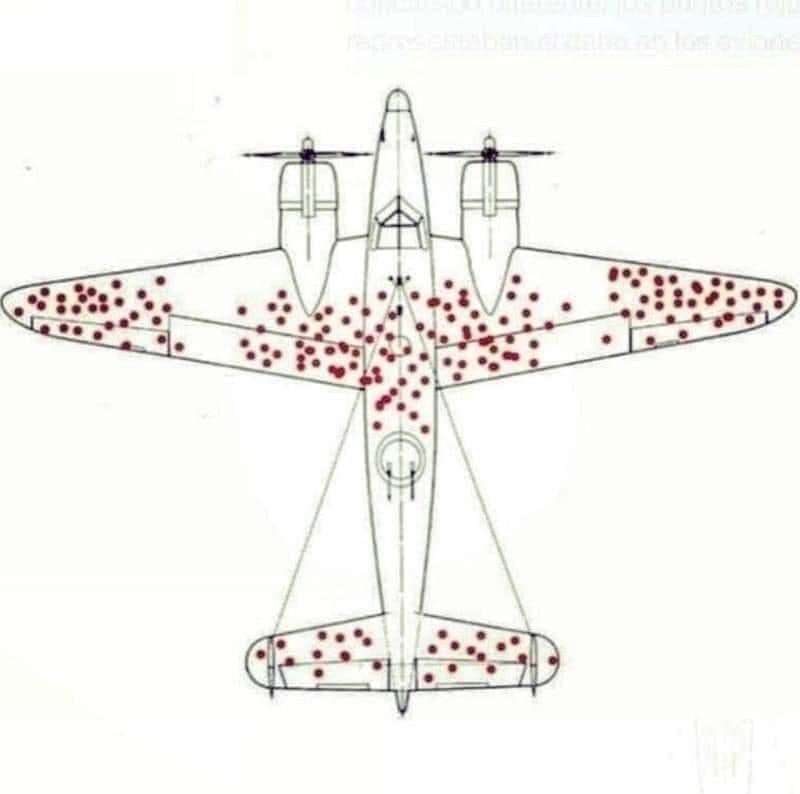

During World War II, the Allies mapped bullet holes in planes that were hit by Nazi fire. They sought to strengthen the planes, reinforce areas heavily damaged by enemy artillery to be able to withstand these battles even more. The immediate decision was to rebuild and reinforce areas of the plane that had more red dots (or received more bullets). Theoretically, it was a logical deduction. After all, these were the most affected areas.

But Abraham Wald, a mathematician, came to a different conclusion: the red dots represented only the damage to the planes that were able to return, that came home.

The areas that really should reinforce, were the places where there were no points because these are the places where the plane would not survive being hit.

This phenomenon is called survival deviation. It happens when you look at the things that have survived when you should focus on the things that don’t.

The investments under greatest pressure at the moment, the ones that are failing, are:

· Those where the investor security is only insurance – because without assets other creditors will pull the plug

· Rental property portfolios – still there unless you borrowed to buy them but totally illiquid and yielding at a very low level or not at all

· Anything crypto or multi-level: new cash isn´t coming in at the bottom so it´s not going out at the top

· Property development where the developer needs to sell new property to the general public. People are not going to buy new in the next 2 years, those with cash will be buying distressed assets from the desperate not new properties from the showrooms

· Tourism – an entire industry brought to its knees and by no means certain to recover

Stay well away from all five of the assets above in order to survive. We have some very safe and profitable investments that pay coupons monthly or quarterly and offer between 2.25% and 5% per quarter with zero risk. They are even tradeable so you are not committed to staying with them longer than you want to. Unlike that rental property you wish you didn´t own!

Get in touch HERE for more details.

By Jonathan Bennion-Pedley

Recent Posts

Archives

- May 2022

- March 2022

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- September 2019

- August 2019

- July 2019

- June 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- August 2018

- March 2018

- February 2018